|

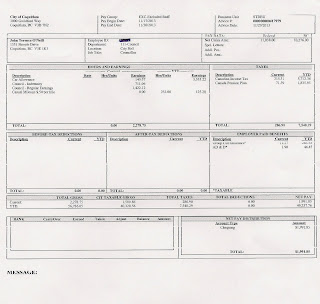

| My 'pay stub.'* |

At first, CIPOWSAU wielded some erroneous math in making his argument to kill the 1.75% hike, incorrectly saying at one point that it would result in the mayor receiving a raise in the magnitude of tens of thousands of dollars a year.

In fact, all the raises for all council will amount to $9,850 a year. This, in turn, creates a 0.01% tax increase, which in turn equals 17 cents a year per household.

But, of course, the strongest argument in favour of killing the increase is one of optics, and I certainly understand how it appealing it might look for a cost-conscious council to axe its own increases.

On the other hand, it's also being penny wise and pound foolish, because the logical outcome for a council that refuses to raise its own pay incrementally is that, because of inflation, council's pay would become increasingly minuscule--to the point where, in 15-20 years or so, qualified candidates might very well decide that its not worth the time and effort to be on council. And that would certainly not be in Coquitlam's best interests.

Moreover, a future council would eventually have to take the always-controversial step (remember Port Coquitlam's quandry of a few years ago?) of attempting to bridge the big gap in one big raise--a move that would have a significant negative impact on the homeowners who happen to be paying taxes in that year, while letting previous taxpayers off the hook.

Personally, I didn't need this year's raise, and said as much to my colleagues in private several weeks ago. I also agree with a position advanced by Mayor Richard Stewart last night that the provincial government should take the issue out of all councils' hands by legislating a standardized pay scale reflecting the size of the jurisdiction being governed.

Ultimately, I supported the increase on the principle that a small, incremental raise in councillors' pay is the best way to link current council remuneration to current taxpayers. Delaying increases only serves to unfairly burden the future taxpayer.

In the end, council voted 7-2 (with Bonita Zarrillo siding with CIPOWSAU) to support the increase.

*I've illustrated this blog with a copy of one of my recent pay stubs. It shows that a councillor's salary for two weeks is $1422.12 before taxes. This works out to just under $37,000 a year. On top of that, we receive a $711 bi-weekly indemnity related to our service, plus a car allowance.

You'll see in the bottom left corner of the print-out that gross year-to-date pay amounts to $57,786. I understand that this figure is higher than you'd rightly conclude (if looking at the above numbers) because it reflects lump-sum retroactive payments we received following the approval of the city-workers contract last year.

And, for the record, councillors are not enrolled in any pension plan, gold- or otherwise-plated.